Here are a few information about the commonest varieties of loans as well as the loan calculators which can help you in the process.

HELOC A HELOC can be a variable-rate line of credit history that permits you to borrow cash to get a established interval and repay them afterwards.

Crisis loans do the job like other personalized loans in that they are paid out back again in regular installments. Phrases can vary from two to seven years. The more time the term, the decrease your monthly payment, but the more you’ll pay Total.

With vendor financing, the likely auto consumer has fewer selections In regards to interest amount browsing, even though It really is there for ease for anybody who would not want to spend time searching or simply cannot get an automobile loan as a result of direct lending.

This copy is for your own, non-commercial use only. Distribution and use of the materials are governed by

Homeowners insurance policies guideHome insurance policy ratesHome coverage quotesBest household insurance plan companiesHome insurance procedures and coverageHome insurance policy calculatorHome insurance coverage critiques

However , you’ll need to make sure you recognize what type of individual loan is best in your condition And exactly how Individuals every month payments will suit into your finances.

Details about economical products not presented on Credit rating Karma is collected independently. Our content material is precise to the ideal of our expertise when posted.

The non-public loan calculator helps you to estimate your regular payments based upon the amount of you wish to borrow, the interest charge, exactly how much time You must fork out it back again, your credit rating rating and income.

If a there is absolutely no most price within the lawful obligation or beneath a usury or rate ceiling, the creditor have to foundation the disclosure on the level of 25% and must disclose that there is no utmost read more rate Which the overall total for repayment disclosed less than § 1026.forty seven(b)(three)(vii)(B) is undoubtedly an estimate and may be better In case the applicable fascination fee boosts.

Full curiosity payments: Taking a look at the full fascination paid out by itself enables you to Review the cost of 1 loan to a different. It's also possible to utilize it as a gut-Look at to make your mind up If your loan is worth it.

This will come out being an $800 big difference which could possibly be a reason for individuals selling an auto in these states to think about A non-public sale.

Origination payment: The charge a lender expenses once you obtain the loan to deal with processing and administrative prices.

47 cash loan would not present loans and we would not have any say inside the premiums or phrases of our lenders. Our expert services are created to take your information after which allow it to be very easy to discover the lender that could very best provide your preferences.

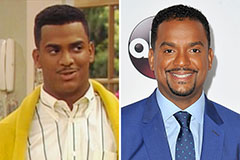

Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Anthony Michael Hall Then & Now!

Anthony Michael Hall Then & Now! Marla Sokoloff Then & Now!

Marla Sokoloff Then & Now! Danielle Fishel Then & Now!

Danielle Fishel Then & Now! The Olsen Twins Then & Now!

The Olsen Twins Then & Now!